The Ultimate Guide To Retirement Planning

Wiki Article

Retirement Planning for Beginners

Table of ContentsWhat Does Retirement Planning Mean?All About Retirement PlanningSome Known Incorrect Statements About Retirement Planning The 9-Second Trick For Retirement PlanningThe Greatest Guide To Retirement PlanningRetirement Planning Things To Know Before You Get This

A 401(k) suit is also a more cost-effective method to use a financial incentive to your employees, as your organization will be paying less in pay-roll taxes than if you supplied a conventional raise or perk, as well as the employee will certainly likewise get more of the money due to the fact that they will not need to pay supplementary income tax - retirement planning.For instance, 1. 5% may not seem like a lot, however just an interest compounds, so do fees. This cash is automatically subtracted from your account, so you might not quickly see that you might be saving countless dollars by relocating your properties to a low-priced index fund, or changing companies to one with reduced financial investment costs.

If you have certain pension where you can add with funds with tax obligations you have actually paid currently vs. paying tax obligations upon the withdrawal of the funds in retirement, you might want to think regarding what would certainly save you much more in tax obligation payments with time. If you have particular shorter term financial investment accounts, assume regarding exactly how much cash you 'd invest there (as well as subsequently pay taxes on in the future) vs.

Our Retirement Planning PDFs

We think that instead of really feeling the pinch post-retirement, it's practical to begin saving early. What you simply require to do is to begin with an attainable saving, plan your investments and also with a long-term commitment. The method you want to spend your retired life completely depend upon the amount of money you have actually conserved as well as spent.

How Retirement Planning can Save You Time, Stress, and Money.

Meeting their heavy clinical expenses and also other requirements in addition to personal family need is truly extremely difficult in today's era of high inflation. retirement planning. Hence, it is recommended to begin with your retirement savings as early as you are two decades old as well as solitary. The senior citizens posture a massive worry on their household that had actually not prepared and also saved for their retirement.There's always a health and wellness problem connected with growing age. There might be a circumstance where you can not function any kind of longer and the savings for retirement will certainly help to ensure that you are well cared of. So the large concern is that can you pay for the expense of lasting treatment considering that it can be extremely pricey as well as is consisted of in the cost of your retired life.

Do you want to keep working after your retired life? The individuals that are unprepared for retired life usually have to maintain functioning to satisfy their official statement family members's demand throughout life.

See This Report on Retirement Planning

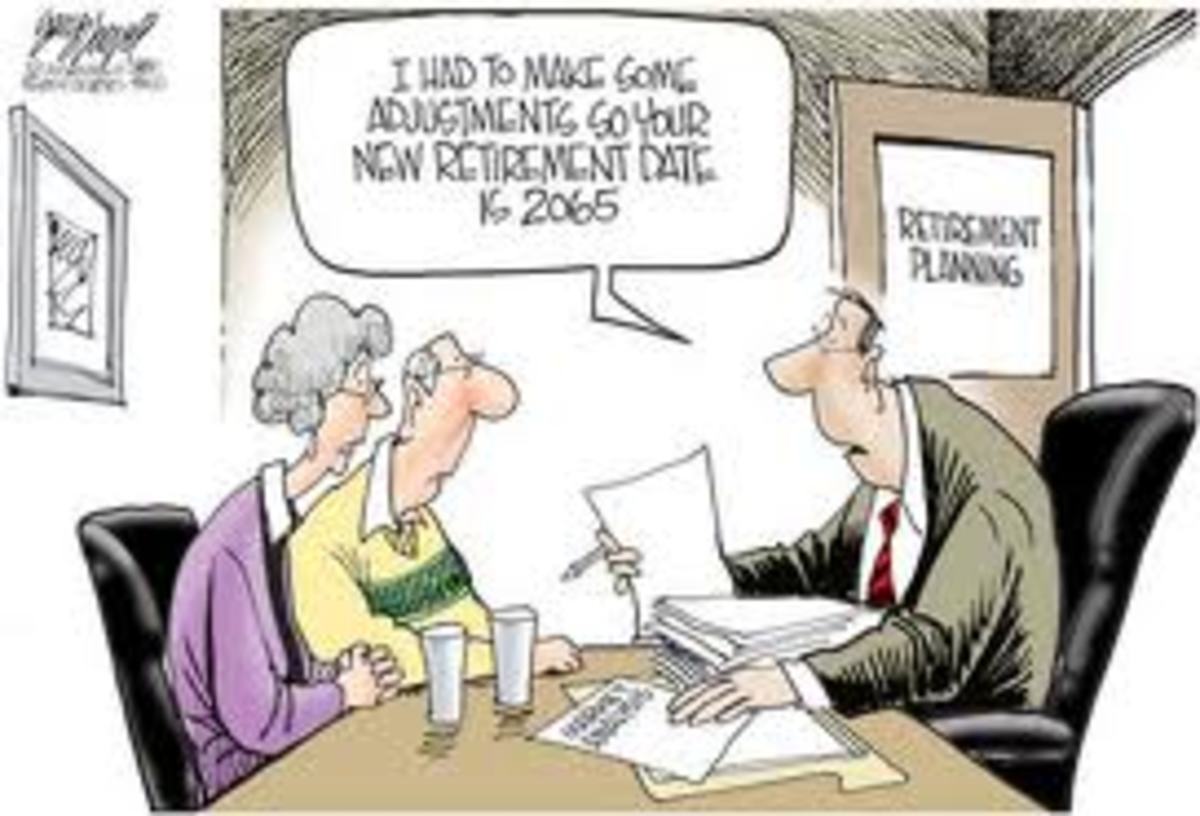

If you start late, it may happen that you have to compromise or readjust yourself with your pre-retirement and also retired life lifestyle. Moreover, the amount that you require to save and also add each period will certainly depend upon exactly how very early you start saving. Starting with your retired life planning in the twenties might seem as well early for your retired life.

Furthermore beginning early will allow you to establish excellent retirement savings and planning practices as well as provide you even more time to remedy any kind of blunder and to recognize any shortfall in accomplishing your goal.: Catch up on your Retirement Preparation in your 50s The retirement plans should be designed and applied as quickly as you begin working.

These financial coordinators will certainly think about different elements to carry out retirement assessment that includes your revenue, costs, age, preferred retired life lifestyle and more. Therefore, use the sweat of your gold years to supply a color in your old days to make sure that you depart the world with the sensation of complete satisfaction and also completeness.

Unknown Facts About Retirement Planning

There is an usual mistaken belief among young staff members, and also it usually seems something like, "I have plenty of time to prepare for retired life. If you wait for the "best" or "right" time, you'll never ever start.

The earlier you obtain started, the much better. It's never ever too late to start. With these two concepts in mind, workers can be motivated to prepare for retired life instantly. Neither their age neither their current funds must come in the way of retirement planning.

The 8-Minute Rule for Retirement Planning

Much of us procrastinate discover this in some cases even the most efficient people, obviously! However when it comes to conserving for retired life, postponing is not encouraged. Early risers do not just get the worm - they obtain 5 celebrity buffets for virtually no initiative. Let's illustrate the cost of procrastination with a story of 3 imaginary pairs.Based on data from the Workplace for National Stats they had 6,444 of disposable earnings per head in 1977. In 1982, they had 7,435 of non reusable earnings per head. By 1987, they had 8,565 These pairs are just the same age The vital distinction in between them is, they didn't all start to save for their retired lives at specifically the very same time.

They determined to save 175 per month (2,100 per year). 29 percent of their yearly income. They got affordable mutual funds, placing 70 percent of their money in supplies, 30 percent in bonds.

Report this wiki page